Declaring related transactions of multinational companies

Ngày đăng: 06/11/2013

Along with global integration, many multinational companies established set of management issues to ensure that the tax revenues of the national importance. Exchange links be construed as business transactions between associated parties . Which party is the party associated with the relationship directly or indirectly in the management, control or capital contribution or investment in any form.

|

Freedom comes from exchange agreement, the parties may offer lower or higher price than the market price. This aims to regulate tax obligations from where to where high tax rates have lower tax rates, reduce the overall tax liability and increase profit after tax by the parties .

Therefore, the need for water management related transactions based on a reasonable basis and can not rely on the consent of the parties. Taxable price of the related transaction is determined by the following methods :

The method compares the independent transaction price: based on the unit price of products in independent transactions to determine the unit price of traded products linked to these transactions is conditional similar transactions .

Resale price method : based on the selling price ( or the price ) of products sold to businesses by independent parties to determine the purchase price of the product from the link .

The cost plus method : based on the cost ( or price ) of products purchased by businesses from independent parties to determine the selling price of the product for the link .

Comparable profits method : based on the profitability of the product in independent transactions selected for comparison as the basis for determining the profitability of products related transactions as these transactions are trading conditions are equivalent.

Profit split method : based on profits from a transaction linked by many businesses aggregate links made to identify each profitable niche business in a way that links independent parties profit sharing in independent transactions equivalent .

Currently, the management mechanism based on voluntary tax returns and pay taxes . Similar to the related party transactions , multinational companies have to declare and pay the tax office during tax annual income .

Typically , companies choose valuation methods consistent with market trading conditions , with the source of information , data , data completeness and reliability to determine the transaction price .

Besides, the Law amending and supplementing a number of articles of the Law on Tax Administration dated 01/7/2013 effect added mechanism agreed upon method of determining the taxable price (called the APA - Advance Pricing Agreement ) .

According to the General Department of Taxation based on the request of the taxpayer or foreign tax authorities to decide APA negotiations .

Give exchange links on the right for the market to protect the interests of the nation but also bring a healthy competitive environment among enterprises together.

Dianam Legislation Committee

Tin liên quan

02/11/2013 12:14

Chuyển đổi đât vườn, vườn liền kề thành đất ở??? Chuyển đổi đât vườn, vườn liền kề thành đất ở???

Chuyển đổi đât vườn, vườn liền kề thành đất ở???Thưa Luật sư, bố mẹ tôi có mảnh đất diện tích 300m2 sử dụng từ năm 1988, đến 2002 thì có...

02/11/2013 10:52

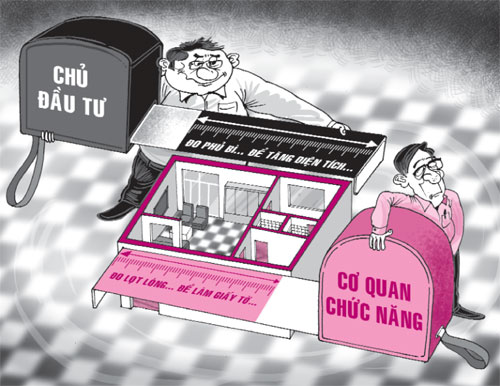

Cách tính nhà chung cư theo luật? Cách tính nhà chung cư theo luật?

Cách tính nhà chung cư theo luật?Thưa luật sư, trong thời gian vừa qua nổi lên nhiều vụ tranh chấp về cách xác định diện tích...

21/10/2013 09:10

Rủi ro khi mua đất bằng giấy tay qua 2 đời chủ Rủi ro khi mua đất bằng giấy tay qua 2 đời chủ

Rủi ro khi mua đất bằng giấy tay qua 2 đời chủNăm 1997 bên B mua thửa đất đó của bên A có làm giấy tay và được chính quyền ấp...

07/10/2013 17:13

Đóng thuế tiền chuyển nhượng hợp đồng góp vốn Đóng thuế tiền chuyển nhượng hợp đồng góp vốn

Đóng thuế tiền chuyển nhượng hợp đồng góp vốnNăm 2001, tôi góp vốn dự án của một công ty, và được chuyển sang hình thức trả tiền...

25/09/2013 14:17

Chuyển nhượng đất tái định cư có phải nộp thuế TNCN? Chuyển nhượng đất tái định cư có phải nộp thuế TNCN?

Chuyển nhượng đất tái định cư có phải nộp thuế TNCN?Xin hỏi trong trường hợp này, tôi có phải nộp thuế thu nhập cá nhân không? Nếu có...

CÔNG TY CỔ PHẦN THƯƠNG MẠI ĐỊA NAM

Hà Nội: số 22D phố Giảng Võ - phường Cát Linh - quận Đống Đa - thành phố Hà Nội

Điện thoại: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Giấy chứng nhận đăng ký kinh doanh số: 0101592377 do Sở Kế hoạch và Đầu tư Thành phố Hà Nội cấp

Bản quyền thuộc Công ty cổ phần thương mại Địa Nam © 2013

Hà Nội: số 22D phố Giảng Võ - phường Cát Linh - quận Đống Đa - thành phố Hà Nội

Điện thoại: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Giấy chứng nhận đăng ký kinh doanh số: 0101592377 do Sở Kế hoạch và Đầu tư Thành phố Hà Nội cấp

Bản quyền thuộc Công ty cổ phần thương mại Địa Nam © 2013

Yêu cầu ghi rõ nguồn "batdongsan.dianam.vn" khi xuất bản tin tức từ trang web.

.png)