Simon Property Debuts Bonds in Europe as Discount to U.S. Widens

Ngày đăng: 26/09/2013

Simon Property Group Inc. (SPG), the largest U.S. mall owner, debuted euro-denominated bonds as the yield discount to U.S. dollar notes approached the widest in more than 4,5 years.

Simon sold 750 million euros ($1 billion) of seven-year securities to yield 75 basis points more than swaps, according to data compiled by Bloomberg. The average yield difference between investment-grade company bonds in euros and comparable dollar notes widened seven basis points in the past week to 1.22 percent, near the biggest discount since 2008, Bank of America Merrill Lynch indexes show.

While Federal Reserve Chairman Ben S.Bernanke holds off from scaling back stimulus in the U.S., European Central Bank policy makers signaled this week they may provide additional loans to banks to keep borrowing costs low, even amid signs the euro-area economy is strengthening. A report today shows consumer confidence in Germany improved more than economists predicted.

“The ECB still runs an accommodative monetary policy given the economic challenges the euro zone still faces,” said Rik Den Hartog, a portfolio manager at Kempen Capital Management in Amsterdam. “For Simon, it’s attractive to sell bonds in euros, since yields are at low levels and it offers an opportunity to match their funding better to their European exposure.”

Simon sold the securities through its Simon Property Group LP unit to refinance a revolving credit facility and for general corporate purposes, according to a person familiar with the matter. Les Morris, a spokesman for the company in Indianapolis, declined to comment on the sale.

Simon sold 750 million euros ($1 billion) of seven-year securities to yield 75 basis points more than swaps, according to data compiled by Bloomberg. The average yield difference between investment-grade company bonds in euros and comparable dollar notes widened seven basis points in the past week to 1.22 percent, near the biggest discount since 2008, Bank of America Merrill Lynch indexes show.

While Federal Reserve Chairman Ben S.Bernanke holds off from scaling back stimulus in the U.S., European Central Bank policy makers signaled this week they may provide additional loans to banks to keep borrowing costs low, even amid signs the euro-area economy is strengthening. A report today shows consumer confidence in Germany improved more than economists predicted.

“The ECB still runs an accommodative monetary policy given the economic challenges the euro zone still faces,” said Rik Den Hartog, a portfolio manager at Kempen Capital Management in Amsterdam. “For Simon, it’s attractive to sell bonds in euros, since yields are at low levels and it offers an opportunity to match their funding better to their European exposure.”

Simon sold the securities through its Simon Property Group LP unit to refinance a revolving credit facility and for general corporate purposes, according to a person familiar with the matter. Les Morris, a spokesman for the company in Indianapolis, declined to comment on the sale.

Next Bonds

Investors demand an average 2.1 percent to hold euro-denominated high-grade notes compared with 3.3 percent for dollar securities, Bank of America Merrill Lynch index data show. The yield premium over swaps for European company debt fell 18 basis points this quarter to 98 basis points, according to the data.

Also in credit markets today, Next Plc (NXT), Britain’s second-largest clothing retailer, priced 250 million pounds ($400 million) of 13-year notes to yield 147 basis points more than U.K. government debt. It was the Leicester, England-based company’s first bond sale in more than two years, Bloomberg data show.

Daimler AG (DAI), the world’s third-biggest luxury automaker, issued 750 million euros of notes maturing in April 2020 to yield 55 basis points more than swaps. The Stuttgart, Germany-based carmaker also sold 500 million euros of three-year floating-rate notes to yield 30 basis points more than the three-month euro interbank offered rate.

In the high-yield market, Italian lender Veneto Banca SCPA sold 300 million euros of notes due January 2016 to yield 4.375 percent. The Montebelluna-based bank is rated BB by Standard & Poor's, two levels below investment grade.

Also in credit markets today, Next Plc (NXT), Britain’s second-largest clothing retailer, priced 250 million pounds ($400 million) of 13-year notes to yield 147 basis points more than U.K. government debt. It was the Leicester, England-based company’s first bond sale in more than two years, Bloomberg data show.

Daimler AG (DAI), the world’s third-biggest luxury automaker, issued 750 million euros of notes maturing in April 2020 to yield 55 basis points more than swaps. The Stuttgart, Germany-based carmaker also sold 500 million euros of three-year floating-rate notes to yield 30 basis points more than the three-month euro interbank offered rate.

In the high-yield market, Italian lender Veneto Banca SCPA sold 300 million euros of notes due January 2016 to yield 4.375 percent. The Montebelluna-based bank is rated BB by Standard & Poor's, two levels below investment grade.

Follows: Bloomberg

Tin liên quan

26/09/2013 11:38

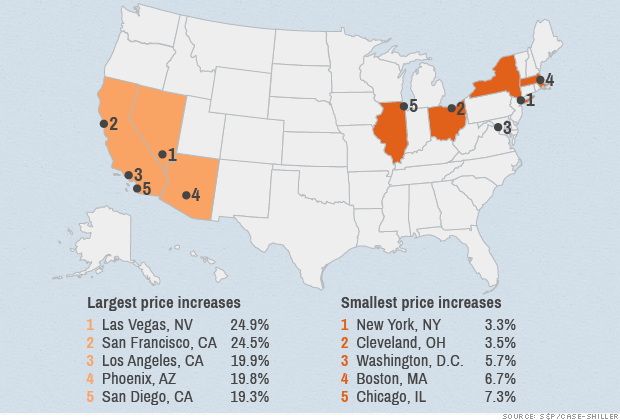

Home prices still surging ... for now Home prices still surging ... for now

Home prices still surging ... for nowPrices for homes in the nation's 20 largest cities in June rose 12.1% over the last year, according to a report Tuesday from...

26/09/2013 11:24

2.5 million mortgage borrowers no longer underwater 2.5 million mortgage borrowers no longer underwater

2.5 million mortgage borrowers no longer underwaterThanks to a sharp increase in home prices last quarter, 2.5 million more mortgage borrowers no longer owe more on their homes than they are worth,...

26/09/2013 08:29

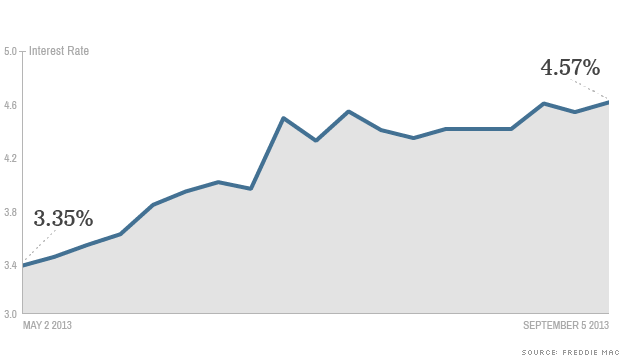

Mortgage rates close to two-year high (again) Mortgage rates close to two-year high (again)

Mortgage rates close to two-year high (again)Rates on 30-year, fixed-rate mortgages reached an average of 4.57% this week -- up from 4.51% last week, according to mortgage giant Freddie...

25/09/2013 17:31

Cảnh hoàng tàn ở khu biệt thự tiền tỷ xây dở Cảnh hoàng tàn ở khu biệt thự tiền tỷ xây dở

Cảnh hoàng tàn ở khu biệt thự tiền tỷ xây dởNhiều biệt thự có giá lên tới hàng chục tỷ đồng bị bỏ hoang, được người...

25/09/2013 17:24

Thị trường biệt thự, liền kề đang chuyển động Thị trường biệt thự, liền kề đang chuyển động

Thị trường biệt thự, liền kề đang chuyển độngLiên tục công bố mở bán các sản phẩm biệt thự, liền kề ở nhiều dự án khu đô thị, khu nhà liền kề thời gian...

CÔNG TY CỔ PHẦN THƯƠNG MẠI ĐỊA NAM

Hà Nội: số 22D phố Giảng Võ - phường Cát Linh - quận Đống Đa - thành phố Hà Nội

Điện thoại: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Giấy chứng nhận đăng ký kinh doanh số: 0101592377 do Sở Kế hoạch và Đầu tư Thành phố Hà Nội cấp

Bản quyền thuộc Công ty cổ phần thương mại Địa Nam © 2013

Hà Nội: số 22D phố Giảng Võ - phường Cát Linh - quận Đống Đa - thành phố Hà Nội

Điện thoại: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Giấy chứng nhận đăng ký kinh doanh số: 0101592377 do Sở Kế hoạch và Đầu tư Thành phố Hà Nội cấp

Bản quyền thuộc Công ty cổ phần thương mại Địa Nam © 2013

Yêu cầu ghi rõ nguồn "batdongsan.dianam.vn" khi xuất bản tin tức từ trang web.

.png)