Part 1: The problem of investment in real estate projects

Post time: 14/10/2013

DianamRe - Implications from real estate projects are "inert liver and minnows grave" as aching pain for Vietnam real estate economy today. A variety of solutions are given from all levels of government to economic experts and real estate investors in recent years with the desire to resolve "local creditors" inventory has been cleared?

The key to the success of a project is to sell quickly, capital recovery and reinvestment. Photo: CafeLand

The process of formation and development of real estate market in Vietnam was not previously under a law of supply and demand . A market is formed from thinking " take advantage " of the majority of investors in the real estate stage " fever " has severe consequences for the disease is " inventory " is switched to " move house " and have to take a lot more years to hopefully resolve .

After " Hurricane " lack of investment and not just sell products " swept " the real estate projects , then what's left everyone startled with the actual figure for thought . In 2012 alone , nearly 700 real estate enterprises decommissioning , closure or bankruptcy . A series of construction projects in progress are " slide up " said the real estate market picture pathetic , tragic . The main reason is due to lack of market development basically , spontaneous . Period 2007 - 2008 , the real estate " boom " , making money from real estate too easily lead to many investors do not have the financial capacity to market participants in a " borrowed the pork porridge " . Until the economic downturn , bank loans was "broken circuit " , investors rush " to walk away from " leave no project " comedy " and become social burdens . There are many reasons , but the main reason is the advent project does not meet the real needs of the beneficiaries .

The remaining businesses are now fully awake and vigilant than before " money down " construction project . In several periods of article series we are going to start posting. We look forward to contributing more multi-dimensional information on the formation and development of real estate projects in developing countries . Hopefully , through the sharing of stories we will help real estate investors in Vietnam with more information and more consider before investing in order to avoid mistakes and unnecessary damage as has happened over time .

A real estate project to be successful is a crucial factor is the stage of market analysis before the product was launched . The real estate businesses previously not pay much attention to market factors analysis . They do not know they make products to sell to whom, for what , for how long to sell ? As a result, many of the projects are " soft cover " the star of the last time as we know it . The success of the business such as Vingroup , Le Thanh vivid examples in the context of the real estate market is in crisis . They know where their strengths , customers are. The attitude is responsible and serious market analysts , scientists . They launched the product line in accordance with the market , and not be consumed fast " seasick " as other investors went on a boat during the real estate investment " boom " before.

The key to the success of a project is to sell quickly , capital recovery and reinvestment . In addition to factors such as cost estimates Tabulation , license , capital , construction design , marketing , distribution , ... In all of the above factors is not beyond the ultimate goal is still profit how many final . In the world there is a term investment strategy to invest in the industry that people do not know that nobody is smart strategy key . SMART PLAN KEY . They rely on letters in the acronym SMART is fundamental in building business strategies and investment are:

S - pecific

M - easurable

A - ttainable

R - ealistic

T - time bound

A market analysis complete , accurate , scientists will determine success by 50 % before the project was launched . The foreign investment projects based on the analysis of new market before making the idea of building projects . But investors Vietnam is the opposite . Market parameters based on fundamental factors such as :

1 / Per capita income

2 / legal regulations

3 / For customers

4 / Connectivity Infrastructure

5 / group public interest for the project

6 / Beauty and utility projects

7 / design costs , construction

8 / management fees and incurred

9 / Marketing Costs

10 / discounts , distribution ...

A suitable product is a product that can meet 60% of average income earners can buy that product . If you compare the average total income of Vietnam is 25 times higher than the new home owner 's income compared with other countries such as Europe 7 times , Thailand and Singapore 5.2 times 6.3 times it really is a difficult problem for the real estate investors in Vietnam .

Term 2 : Analysis of the key real estate investment SMART

Lecturer Huynh Anh Dung - U.S. CRS ( School of International Training Leader Real )

Related News

11/10/2013 09:14

Có tiền nên mua căn hộ cao cấp Có tiền nên mua căn hộ cao cấp

Có tiền nên mua căn hộ cao cấpTại họp báo sáng 8/10, trả lời câu hỏi của VOV.VN về việc nên chọn loại bất động sản nào để mua trong thời...

11/10/2013 09:02

Chọn bất động sản: Vị trí, vị trí và vị trí Chọn bất động sản: Vị trí, vị trí và vị trí

Chọn bất động sản: Vị trí, vị trí và vị tríTổng giám đốc điều hành của 3 công ty tư vấn bất động sản nước ngoài tại Việt Nam chia sẻ...

09/10/2013 15:08

Địa ốc Hà Nội bung hàng trong quý cuối năm Địa ốc Hà Nội bung hàng trong quý cuối năm

Địa ốc Hà Nội bung hàng trong quý cuối nămKhông chỉ những dự án cao cấp, nhà thương mại mà ngay cả những khu nhà thu nhập thấp đều...

07/10/2013 16:55

TPHCM: 2000 nhà tái định cư thành nhà xã hội TPHCM: 2000 nhà tái định cư thành nhà xã hội

TPHCM: 2000 nhà tái định cư thành nhà xã hộiTừ nay đến cuối năm 2013 sẽ có gần 2.000 căn hộ tái định cư tại các dự án trên địa...

07/10/2013 10:49

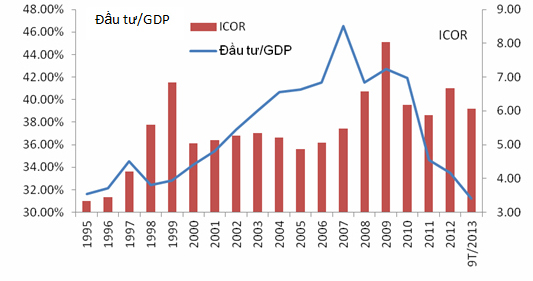

Rủi ro của kinh tế Việt Nam vẫn đang phía trước Rủi ro của kinh tế Việt Nam vẫn đang phía trước

Rủi ro của kinh tế Việt Nam vẫn đang phía trướcDianamRe - Tăng trưởng GDP quý 3 đạt 5,54% và trong 9 tháng đạt 5,14%, cao hơn so với cùng kỳ năm...

DIANAM TRADING JOINT STOCK COMPANY

Hanoi: no 22D Giang Vo | Cat Linh | Dong Da | Hanoi

Tel: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Number of Certificate of business registration: 0101592377 by Department of Planning and Investment in Hanoi.

Hanoi: no 22D Giang Vo | Cat Linh | Dong Da | Hanoi

Tel: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Number of Certificate of business registration: 0101592377 by Department of Planning and Investment in Hanoi.

Copyright by Dianam Trading Joint Stock Company © 2013

Requirements write "batdongsan.dianam.vn" when publishing news from this site.

Requirements write "batdongsan.dianam.vn" when publishing news from this site.

.png)