How to declare and pay taxes on foreign contractors

Post time: 06/11/2013

This is one of the problems many businesses are interested in making declaration and payment of foreign contractors.

|

Answer questions Hyundai Engineering & Construction Company Co.Ltd of declaration and payment of cash advances , General Department of Taxation (GDT) guidelines :

In paragraph 3 of Article 18 of Circular No. 28/2/2011 dated 28/2011/TT-BTC of the Ministry of Finance guiding some articles of the Law on Tax Administration regulations on VAT , corporate income tax for foreign contractors :

Foreign contractors and subcontractors foreign direct implementation of VAT by the credit method , income tax at the rate of % of the revenue tax filing , tax finalization declaration dossiers to tax agencies directly inside of Vietnam .

a) Declaration of VAT by the credit method prescribed in Article 10 of this Circular .

b ) Income tax return at the rate of % of its revenue is generated for each time when foreign contractors receive payment and finalization at the end of the contract

In case of foreign contractors receive payment several times during the month , you can sign up for monthly tax declaration instead of the time of filing . "

Pursuant to the above provisions , the case of Hyundai Company is a foreign contractor to build the project the Mong Duong 1 Thermal Power Plant under contract number 150 911 ADB/MD1-TPIP.EPC dated 15/9/2011 , payment of VAT by the credit method , income tax at the rate of % of the sales tax , in the contract it signed with the company Hyundai Vietnam Vietnam regulated parties to pay an advance amount by rate% of contract value to the company Hyundai contract performance , the Company is responsible Hyundai declare and pay tax on this amount as prescribed in advance .

Where the Hyundai company received advance payment several times during the month , you can sign up for monthly tax declaration instead of opening times incurred by cash advance.

Philatelic

Related News

06/11/2013 11:28

Đăng ký nhãn hiệu hàng hóa theo Thỏa ước Madrid Đăng ký nhãn hiệu hàng hóa theo Thỏa ước Madrid

Đăng ký nhãn hiệu hàng hóa theo Thỏa ước MadridThỏa ước Madrid về đăng ký quốc tế nhãn hiệu được ký tại Madrid năm 1891. Việt Nam tham gia Thỏa...

06/11/2013 10:52

Named Vietnamese for foreign businesses Named Vietnamese for foreign businesses

Named Vietnamese for foreign businessesAccording to the Enterprise Law 2005, the business name must be placed by Vietnamese, including the names of foreign enterprises. Therefore, foreign...

06/11/2013 10:45

Declaring related transactions of multinational companies Declaring related transactions of multinational companies

Declaring related transactions of multinational companiesAlong with global integration, many multinational companies established set of management issues to ensure that the tax revenues of the national...

02/11/2013 12:14

Chuyển đổi đât vườn, vườn liền kề thành đất ở??? Chuyển đổi đât vườn, vườn liền kề thành đất ở???

Chuyển đổi đât vườn, vườn liền kề thành đất ở???Thưa Luật sư, bố mẹ tôi có mảnh đất diện tích 300m2 sử dụng từ năm 1988, đến 2002 thì có...

02/11/2013 10:52

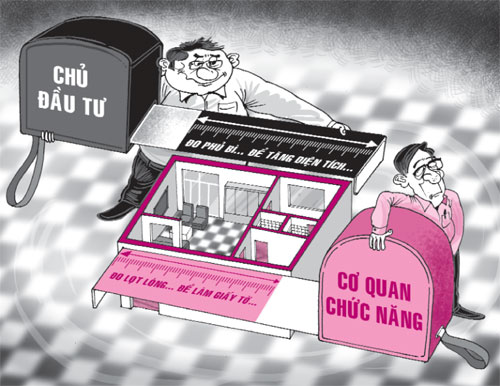

Cách tính nhà chung cư theo luật? Cách tính nhà chung cư theo luật?

Cách tính nhà chung cư theo luật?Thưa luật sư, trong thời gian vừa qua nổi lên nhiều vụ tranh chấp về cách xác định diện tích...

DIANAM TRADING JOINT STOCK COMPANY

Hanoi: no 22D Giang Vo | Cat Linh | Dong Da | Hanoi

Tel: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Number of Certificate of business registration: 0101592377 by Department of Planning and Investment in Hanoi.

Hanoi: no 22D Giang Vo | Cat Linh | Dong Da | Hanoi

Tel: (+84) 4 3787 8822 - Fax: (+84) 4 3787 8282

Email: info@dianam.vn - sanbds@dianam.vn

Number of Certificate of business registration: 0101592377 by Department of Planning and Investment in Hanoi.

Copyright by Dianam Trading Joint Stock Company © 2013

Requirements write "batdongsan.dianam.vn" when publishing news from this site.

Requirements write "batdongsan.dianam.vn" when publishing news from this site.

.png)